Logistics Update January

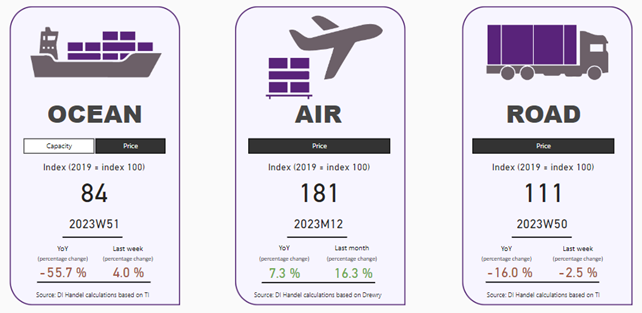

Logistics markets has for a large part of 2023 been stable, however, the last months of 2023 changes this view. Where road transport has generally been stable, ocean carriers face a series of different challenges and air transport sees increasing rates as demand surges.

Ocean

Ocean freight faces two prominent risks currently. Firstly, the situation in the Red Sea affects shipping in terms of longer transit times to/from the Far East. Vessels going around Africa has increased lead times of approx. 10 days, which affects capacity and drives additional costs. A highly effective strategy for risk management during this crisis involves urging suppliers to secure their bookings well in advance. Experts advise suppliers to make their bookings 3-4 weeks prior to departure of vessel.

Secondly, climate change still poses as a threat. The Panama Canal has, to preserve water supply for the population, reduced the capacity of traffic passing through. This also makes the risk of delays for ships passing through the canal larger.

The dangers and threats from passing through the two canals, has made carriers face a dilemma of whether they should pass through the canal or reroute ships to follow a new course. Prices have reacted to these threats, where a general downward sloping trend has been switched to an upward trend. From the 29th of December 2023 to 4th of January 2024, freight rates for selected major routes rose by 60,9 pct. It is however primarily routes passing through The Red Sea, that have seen large increases in shipping rates, where routes that are not directly affected by geopolitical tensions, remain more stable.

Both EU, US and Asian ports report stable operations.

Air

In Q4 2023, the dynamics of global logistics continue to evolve, impacting inflationary pressures and trade patterns. While extremely elevated logistics costs were a significant contributor to inflation during the pandemic, there have been notable shifts in the market since the spring of 2022. Where inflation has sunk to a 3-4 pct. range for the EU and US, it was stable at around 3 pct. for Japan.

Despite easing inflation, Air freight has seen increasing rates over the last period of 2023. For December 2023, prices for selected major routes averaged a price level that was 81 pct. above 2019 levels. Comparatively, prices for September 2023 were only 39 pct. above the 2019 level. Experts point towards rising demand for Asia-related trade as the major driver of this price increase.

Road

For Q4 2023 demand is still at low level with volume around 5-8 pct. less than same period 2022. Capacity is still available in the market and there are generally no disruptions. Rates are still somewhat stable, maybe slightly decreasing, compared to the same period last year. Prices are still above pre-covid levels.

In September 2023 the Danish Ministry of Transport revealed a pilot experiment with 34-meter vehicles between major hubs Hoeje Taastrup & Aarhus, which was launched on the 1st of January 2024. Previously max. length was 25.25 meters. The aim of this pilot experiment is to see if it can increase efficiency and decrease emissions on line haul traffic. However, experts do not expect above to have short term impact on either overall capacity or prices. An extended description of the pilot experiment can be found at the Danish Ministry of Transports website: Ekstra lange lastbiler på motorvejen skal give klimagevinster og afhjælpe trængsel (trm.dk)

Most recent news & the overall political agenda within the Transport area in Denmark can be followed by signing up for newsletter from our colleagues in DI Transport: DI Transport

Interactive logistics dashboard

As a member of DI Handel, you can access the interactive logistics dashboard right here: Logistics Barometer