The economy is heading for a very soft landing

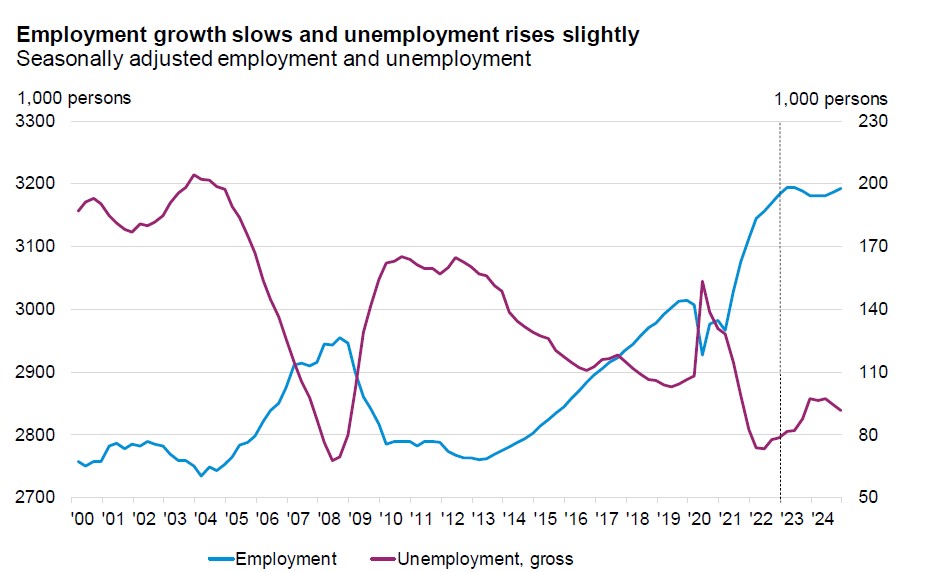

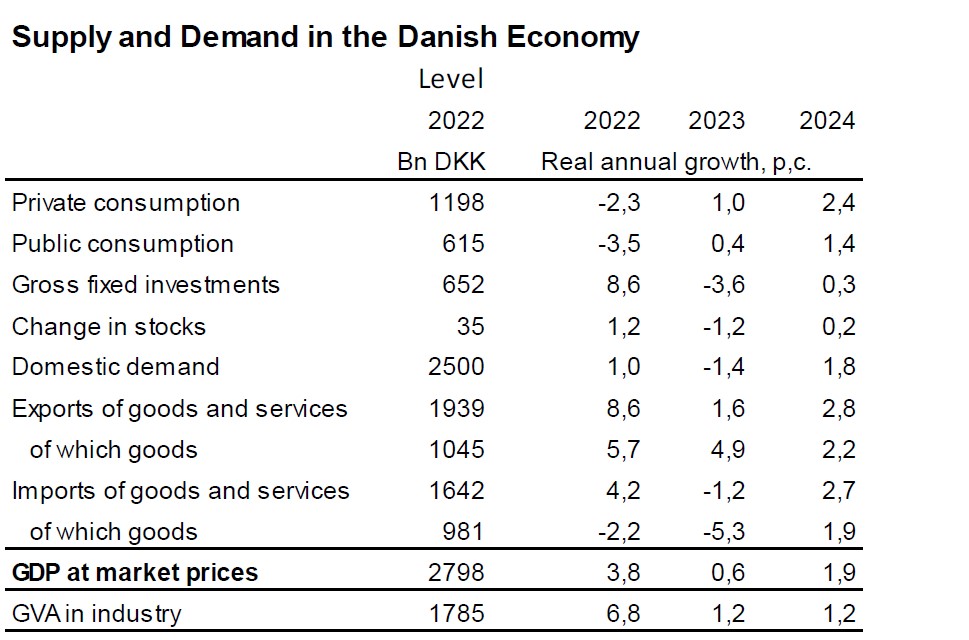

It is expected that the Danish economy is heading for a very soft landing. GDP is expected to grow by 0.6 percent in 2023 and by 1.9 percent in 2024. The high level of in-flation and increasing interest rates will, with some delay, drag down activities and employment in the second half of the year. Employment, how-ever, will remain at a very high level, and the shortage of labour will continue to be a major challenge.

The Danish economy has done much better during the last six months than feared. Last autumn, we were faced with the highest level of inflation in 40 years, massive increases in interest rates and a historical low level of consumer confidence. In spite of economic headwinds, the economy has continued to grow in both the 4th quarter of 2022 and the 1st quarter of 2023. The progress in the economy is clearly reflected on the labour market. Employment has continued its increase during winter.

Source: Statistics Denmark and DI

During winter, economic growth has been supported by, among other things, a strong pharmaceutical industry. The economic head-wind due to the high level of inflation and due to increases in interest rates is still present. The inflation has turned out to be a little more resilient than first thought, and interest rates have increased even further. The level of confidence in the economy has seen a slight increase but remains at a low level. Experience from the US shows that the effects of a monetary policy tightening are delayed by 12-18 months. DI, therefore, expects to see the negative effects in the Danish economy during 2023. However, the decline will be lower than previously estimated.

Both GDP and employment are currently at a record high level, and although we expect a dip in activity in the autumn, annual growth in both GDP and in employment will be positive in 2023. GDP is estimated to grow by 0.6 percent in 2023 and by a further 1.9 percent in 2024. Part of the growth in 2024 comes from the reopening of the Tyra Oil and Gas Field (which is contributing by 0.5 percentage points to GDP in 2024). The growth in industry will only amount to 1.2 percent in 2024.

When looking at 2023 as a whole employment will be 26,000 individuals higher than in 2022. However, the number includes a decrease of almost 15,000 individuals in the second half of the year. Despite a slight cooling of the labour market in the second half of 2023, we will continue at a very high level of employment as well as a low level of unemployment. Thus, we will continue to have a great deal of pressure on the labour market. A pressure that is greater than previously estimated. This could mean that some companies will continue to face lack of staff, thus having to turn down new orders.

The economic development may differ a great deal across different sectors. There is, for example, the prospect of a decline within the construction industry, while the pharmaceutical industry (which traditionally is less sensitive to different business cycles) might be able to remain relatively unaffected by the inflationary crisis. A handful of very large companies are of such importance to the Danish economy that their development is reflected directly in the GDP.

Danish GDP can be affected by large individual companies

Novo Nordisk and Mærsk are both, by Danish standards, incredibly large companies. The development of these two companies is therefore reflected very clearly in the Danish national accounts. This also applies to the oil and gas extraction from the North Sea.

The production of the pharmaceutical industry increased by just over 15 percent in the 1st quarter. This corresponds to an annual effect on Danish GDP of approximately DKK 10bn.

The shipping industry has contributed significantly to the Danish economy in 2022. In 2022 export revenues stemming from sea transport were DKK 531bn, which is almost DKK 200bn more than in 2021. The real economic significance is somewhat less, since a large part of the development is driven by higher freight rates. The development of income from sea transport is of the utmost importance to the balance of payments.

Extraction of gas from the North Sea has laid still for a period, but the expected reopening of the Tyra Oil and Gas Field will have a positive effect on the GDP. The reopening of the Tyra Field is estimated to lift Danish GDP by 0.5 percent in 2024.

Currently, there is great uncertainty about the development in the economy. Developments in the war in Ukraine, the increase of the U.S. debt ceiling and the effect of the reopening of China may all affect the development of the world economy, but the uncertainty is particularly linked to the development in the inflation and the ef-fects of the monetary policy tightening.

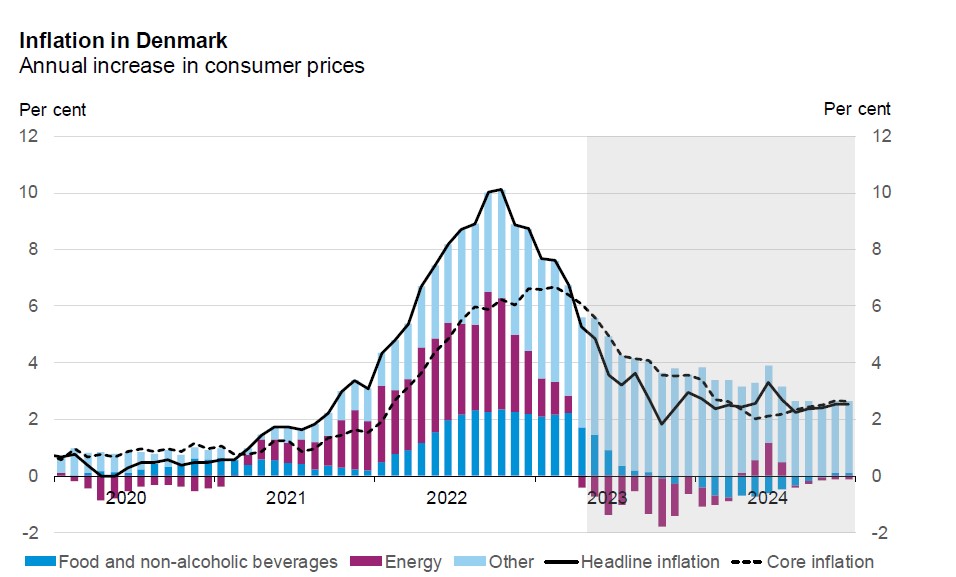

Inflation has peaked

The inflation in both Denmark and in the rest of Europe reached its peak in the autumn. In Denmark, the inflation was only briefly above ten percent. Annual price increases have slowed down during the past six months, and inflation was 5.3 percent in April. It is the decrease in energy prices in particular, that help dampen the inflation. Core inflation has proven to be a bit more stubborn and is now higher than the total inflation rate.

The inflation in commodities is clearly slowing down. Recent months have shown falling commodity prices, and in April, we also saw a decrease in food prices. Lower level of prices on energy, raw materials and freight are helping to ease the pressure on commodity prices. In April, sales prices in the industry were just 1.5 percent higher than in the previous year. The lower level of pressure from producer prices suggests that commodity inflation will decrease further in the coming months.

The price increases for services remain at a high level. Services make up for half of the total of the consumer price index. In order to bring down overall inflation, it is crucial that price increases for services calm down.

DI expects the price increases for services will decrease to approximately three percent at the end of 2024. From 2011 to 2021, service inflation was on average just below two percent per year.

Source: Statistics Denmark and DI

Growth under pressure in 2023

Danish economy has done well through the winter period. However, the high level of inflation and the many increases in interest rates will weaken growth in the coming quarters. During the winter months, growth was largely driven by a surprisingly large drop in goods imports. Imports are expected to increase again after the 1st quarter of 2023, which will help dampen growth. DI expects a general decline in activities in the second half of 2023. A decline that will be followed by renewed growth in 2024. GDP is estimated to increase by overall 0.6 percent in 2023 and by 1.9 percent in 2024.

In 2023, growth will, in particular, be held back by falling investments and a significantly lower level of inventory build-up than in 2022. Inventory investments were at an extraordinarily high level in 2022. In 2023, private consumption and business investments, in particular, are expected to pick up a bit more. The expected reopening of the Tyra Oil and Gas Field will also make a significant contribution to growth in the Danish economy in 2024. Growth in industry is significantly lower than the impression given by GDP growth.

Note: Change in stocks as a percentage of GDP in the previous year

Source: Statistics Denmark and the Confederation of Danish Industry

Employment is expected to decrease slightly in the second half of 2023. Growth should be large enough to ensure an increase in employment during 2024. By the end of 2024, employment will be at approximately the same level as now, which indicates continued significant pressure on the labour market.